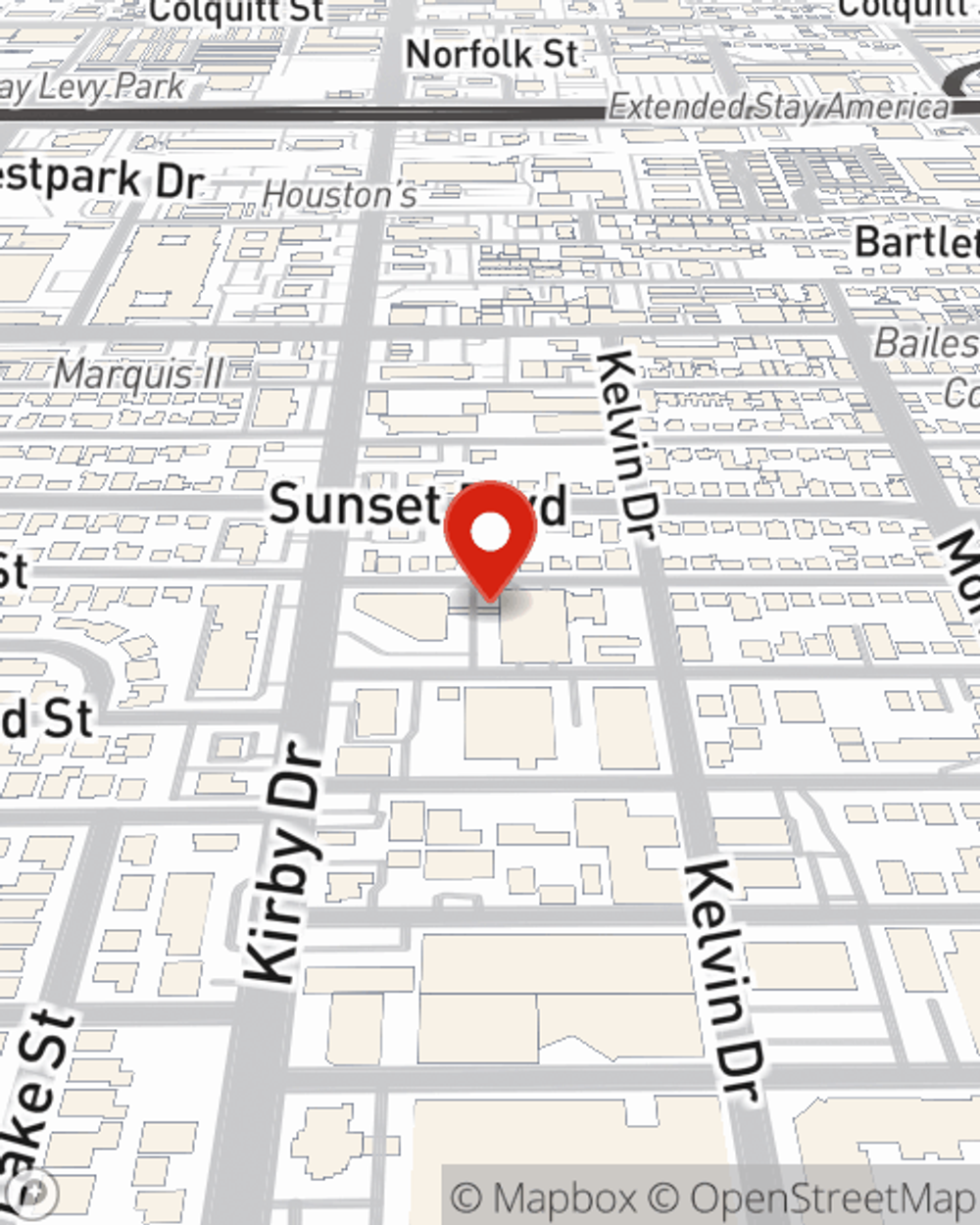

Condo Insurance in and around Houston

Townhome owners of Houston, State Farm has you covered.

Protect your condo the smart way

Your Personal Property Needs Coverage—and So Does Your Condo.

When looking for the right condo, it's understandable to be focused on details like location and home layout, but it's also important to make sure that your condo is properly covered. That's where State Farm's Condo Unitowners Insurance comes in.

Townhome owners of Houston, State Farm has you covered.

Protect your condo the smart way

Condo Unitowners Insurance You Can Count On

You’ll get that and more with State Farm Condo Unitowners Insurance. State Farm has plenty options to keep your condo and its contents protected. You’ll get coverage options to accommodate your specific needs. Fortunately you won’t have to figure that out alone. With empathy and fantastic customer service, Agent Sam Ewing can walk you through every step to help build a policy that shields your condo unit and everything you’ve invested in.

Getting started on an insurance policy for your unit is just a quote away. Get in touch with State Farm agent Sam Ewing's office to check out your options.

Have More Questions About Condo Unitowners Insurance?

Call Sam at (713) 521-0481 or visit our FAQ page.

Simple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Simple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.